Outside of the City of Spokane, more than 30 items are up for a vote in Spokane County — although any individual Spokane Countian (does that have a ring to it?) will only see a couple, or maybe three of these options on their own ballots.

That’s because this is a hyper-local election. That’s right folks: we’re talking individual school districts, fire districts and library districts, which are all among the smallest units of democracy we get to directly vote on as citizens. These are not items that affect all 550,000 of us equally. It’s money for the schools that serve your town of 808, and the rural fire districts that protect your land from lightning strikes and the surprisingly large number of people for whom flicking smoldering cigarette butts onto bone-dry grazing land is a cherished summer pastime.

This stuff is pretty important, and because it’s so local, voters tend to weigh these things less on partisan politics, national mood or pure ideology (*sniff*), and more on perceived community value. (For an example when a failed levy quickly became a catastrophe that has remade local politics, see “West Bonner School District 2023”.)

We can see in our mind’s eye what it would be like to walk in our local library and find fewer books on the shelves and no librarians available to help us pick our next sword & sorcery bodice ripper — or to not be able to use a library at all on the weekend. We intuitively understand the societal harm of our kids reading from current affairs textbooks that talk about Nixon opening China in the present tense. And of course, as humans — the imagination animals! — we can picture the horror of desperately needing the services of Spokane County Fire but, rather than a water truck rolling up to your brush fire, you get three dudes and an old Dalmation in a Mazda Miata taking turns with a Super Soaker.

And though these elections are direct and intimate, it doesn’t mean the ballots are a breeze to read and understand. The language runs the gamut from arcane to jargon-filled. What’s the difference between a levy and a bond again? “A replacement levy that raises taxes” What does that even mean? Is it replacing a tax or raising a tax?

Don’t worry though: your job is to vote. Our job is to explain what you’re voting on.

You have to do your job very soon — make sure to return or postmark your ballot by 8 pm, February 13 (this coming Tuesday) — so we are doing our job right now.

How to vote and by when

This one’s the most straightforward: all ballots must either be mailed and postmarked by February 13 — meaning you need to drop it in the mailbox before that box gets picked up for the day — or dropped in an election drop box by 8 pm that night. There are 27 ballot drop boxes around the county. Find the closest one to you here.

Common Ballot Terminology

Or, Replacement levies, capital levies and replacement capital levies, oh my!

The first trick to understanding the ballot is to know some of the common terminology. Most items up for election this round are levies — votes to authorize property taxes.

Who pays property taxes? Though there are exceptions, property taxes are paid by property owners. If you own a home, you are a property owner. If you rent, your landlord does. Renters don’t pay property taxes directly, though your landlord probably calculates it into the rent.

Most of the levies on this year’s county ballots fall into one of two categories: replacement levies and capital levies, which pay for different things.

A replacement levy asks voters if they want to continue charging the property tax property owners already pay for whatever service is on the ballot. Levies for operating schools, libraries and such usually expire after a set number of years, at which point voters need to vote on a new levy. A replacement levy does not always match the precise percentage of the levy it replaces because the taxing authority assesses shifts in property values before deciding the percentage, but it is usually similar. However, the total amount of tax collected generally does increase marginally as property values rise, which could result in each household paying $100 or so more than they did last year. This reflects a growing economy more than a tax increase. If the replacement levy fails, the services that had previously been funded by the levy could go away as well. In terms of schools, this often includes Advanced Placement classes, music programs, athletics, safety staff and teachers’ salaries.

A capital levy is a one-time property tax that is usually tied to a specific project or projects. In Washington, this is often the construction of new schools, renovations of existing schools or large maintenance projects. The projects are generally specified in the ballot resolution.

If passed, the project would be funded and move forward. If a capital levy isn’t passed, it wouldn’t affect the existing services, but would hamper the stated project tied to the capital levy from moving forward. Sometimes capital levies pay for the cost of an entire project, but just as often they act as the local portion of a funding scheme that also includes state, federal and potentially even private dollars — either grants or loans.

Different goal posts: Besides funding different things, these different kinds of levies often have different requirements to pass. Even in the same school district, for example, a replacement levy for operations might require a simple majority to pass (50% + 1 vote), while a capital levy might require a supermajority of 55%, 60% or more.

Complicating this, there are also “replacement capital levies” that will appear on certain ballots. A replacement capital levy is designed to continue capital levies that are expiring but fund the same types of improvements there will be a continued need for. For example, Cheney’s Proposition 3 explains that “Deteriorating infrastructure … student and staff security needs, the needs of the District’s educational programs require the District to support the modernizing and remodeling of school facilities by continuing to fund technology, security, and infrastructure improvements.”

Another thing to look out for is what percentage of the vote the items need to pass. Some require a simple majority of voters, while others, like bond measures (see below), require a 60% supermajority, with a 40% voter turnout, based on the number of people who participated in the previous election.

There are some other, less common kinds of ballot initiatives on Spokane County ballots this coming election. One asks voters to annex the Town of Fairfield into Spokane County Fire Protection District 2. For the last two decades, Fairfield has paid the fire district for fire protection. But, this setup has the potential to create a situation in which the voters of Fairfield might pay an increased tax bill without having had a chance to vote on it, according to the Spokesman. If approved, a certain amount of Fairfield taxes would go directly to the fire district. The annexation measure requires support from a majority of voters in Fairfield and in the fire district.

Lastly: bonds. A bond is essentially a governed body’s IOU to its government, saying it will consent to taxes, to be implemented in the future, that will pay for projects that are ready to be implemented now. Similar to a capital levy, a bond is usually dedicated to a specific new project, like building a new school, as West Valley School District’s Proposition No. 2 seeks, in part, to do. The difference is that a ballot measure for a bond doesn’t create the revenue stream right away. It’s a little bit like charging a credit card: the government will have to find a way to pay for the project – usually a tax – in the future.

The voting ecosystem is complicated, but these basic concepts can demystify some of the governments’ legalese that tends to obscure how a measure will affect your life. The measures are organized alphabetically by the name of the taxing authority. Each entry includes some information listed in each measure’s “explanatory statement,” a part of the document that, in part, itemizes expenses. (Some entries lack an explanatory statement.) So sit back, relax and learn what’s on your ballot so you can get your vote in by Tuesday.

Central Valley School District - Proposition 1

Replacement levy of .24% expected to bring in nearly $1.4 million for general fund spending on educational and operational costs.

The explanatory statement reads, in part: “Taxes collected by this replacement levy will be used to pay expenses of educational programs and operations not funded or fully funded by the State, including teacher and classified staff compensation, special education, nurses, counselors, safety staff, music, athletics, advanced courses, extracurricular activities.”

Central Valley School District - Proposition 2

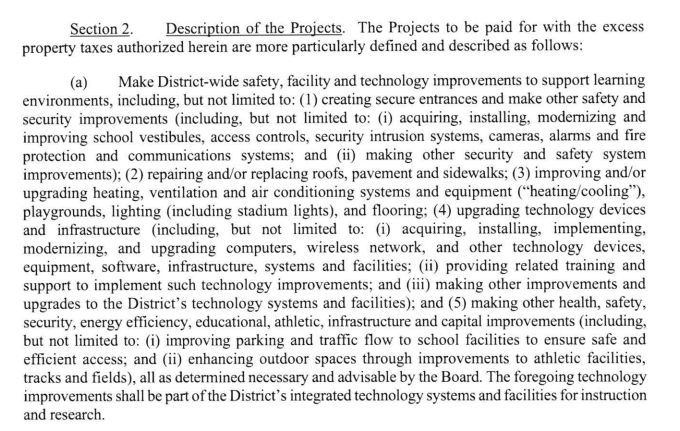

Capital levy for .039% designed to bring in $47.5 million over the next six years for construction, modernization and remodeling of school facilities. This will include upgrades to existing technology in classrooms, according to the Spokesman.

The explanatory statement reads, in part, that the passage of the prop would allow the district to “levy taxes over a six-year period to pay costs of making District-wide safety, facility and technology improvements to support learning environments, including: (1) creating securer entrances and make other safety and security improvements (including improving school vestibules, access controls, security intrusion systems, cameras, alarms and fire protection and communications systems); (2) repairing roofs, pavement and sidewalks; (3) improving heating/cooling systems, playgrounds, lighting (including stadium lights), and flooring; (4) upgrading technology devices and infrastructure (including: (i) upgrading computers, wireless network, and other technology equipment and infrastructure; and (ii) providing training to implement such technology improvements).”

Cheney School District - Proposition 1

Replacement levy of .197% expected to generate about $51 million for general fund spending on educational and operational costs.

The explanatory statement reads, in part, that the money collected would be used to “pay expenses of educational programs and operations not funded by the State, including, school safety, athletics, extracurricular activities, art, music, special education and staffing above the State allocation.”

Cheney School District - Proposition 2

Bond of no more than $72 million to buy land and construct new instruction buildings to relieve overcrowding in the district’s schools.

The explanatory statement reads, in part, that bond would allow the district to “(1) construct one additional elementary school in Airway Heights, on a site owned by the District on South Craig Road and West 1st Avenue; (2) make District-wide health and facility improvements (including expanding kitchens and improving bus loops at Salnave and Windsor Elementary Schools; upgrading HVAC; connecting old sections of buildings into new sections at CHS and Betz, Sunset and Windsor Elementary Schools); and (3) acquire land for new and expanded facilities of the District. The School Board determined that these projects were necessary to relieve overcrowding and provide safe, modern facilities.”

Cheney School District - Proposition 3

Replacement capital levy of .009% expected to generate $2.3 million for modernizing and remodeling school district facilities.

The explanatory statement reads, in part, that the taxes “ will be used to pay costs of making technology, safety, security and infrastructure improvements throughout existing school facilities, including: (1) acquiring, installing, implementing and modernizing instructional technology equipment, infrastructure, systems and facilities; (2) acquiring, installing, implementing and modernizing security cameras, entry/access controls, door locks and other safety and security systems; (3) upgrading and/or improving other infrastructure for safety (including bleachers, locker rooms, heating and cooling systems and equipment, electrical and plumbing).”

Deer Park School District - Proposition 1

Replacement levy for .15% expected to bring in more than $11 million over three years for general fund spending on educational and operational costs.

The explanatory statement reads, in part: “Passage of Proposition No. 1 would allow Deer Park School District to replace an existing educational programs and operations levy that will expire at the end of 2024. The taxes collected by this replacement levy will be used to pay expenses of educational programs and operations not funded by the State, for example, student extracurricular activities, athletics, music, class size reduction, safety and security, nursing staff and technology.”

Deer Park School District - Proposition 2

A bond of $62 million to build a new elementary school. The bond allows the district to levy taxes to pay the principal and interest.

The explanatory statement reads, in part, that the bond would enable the district to “(1) construct a new elementary school (Grades 2-5) and transportation facility on a site to be acquired by the District located on East D Street; (2) renovate and modernize Arcadia Elementary School to accommodate Home Link; and (3) renovate and modernize Deer Park Middle School. The School Board determined that these projects are necessary to relieve overcrowding and provide safe, modern facilities to enhance the student learning environment.”

East Valley School District - Proposition 1

Replacement levy expected to generate $42.4 million for general fund spending on educational and operational costs. The tax will diminish slightly for each of the three years it will be in effect. The first year, it will amount to .206%, the second, .199%, and the third .195%.

The explanatory statement reads, in part, “the taxes collected by this replacement levy will be used to pay expenses of educational programs and operations not fully funded by the State, including teachers, staff, class size, athletics, after school programs, transportation, technology, special education and maintenance.”

Town of Fairfield & Fire District 2 - Proposition 1

Annexation of the town of Fairfield into Fire District 2. Currently, the Town of Fairfield pays Fire District 2 to provide fire services, but this brings with it issues of taxpayer representation. Both the voters of Fairfield and of Fire District 2 will vote on this ballot measure.

Fire District 5 - Proposition 1

New, regular .15% property tax to pay for normal maintenance, equipment and training to the fire district.

The explanatory statement reads, in part: “The District Board has determined that the tax levy and the revenue it will produce is necessary to maintain the current level of services, fire fighter staffing, equipment and facilities and to purchase additional equipment and apparatus to continue to improve services for the protection of life and property in the District and to enhance public safety.”

Freeman School District - Proposition 1

Replacement levy of .15% for just more than $6 million for general fund expenditures on education and operational costs.

The explanatory statement reads, in part, that the taxes collected will be used to “pay expenses of educational programs and operation not funded by the State, including class size reduction, special education, nurses, counselors, safety staff, music, athletics, extracurricular activities, instructional materials and supplies, and facility maintenance and operations.”

Freeman School District - Proposition 2

Replacement capital levy of .125% for the next three years, expected to yield just more than $5 million for “modernization and remodeling of school facilities” to make them accessible and bring them in line with the Americans with Disabilities Act.

The explanatory statement reads, in part, that the taxes collected would “pay costs of making District-wide safety, security, technology and infrastructure improvements to support learning environments, including: (1) upgrading security cameras, entry controls and other safety and security systems; (2) upgrading computers and other technology equipment, infrastructure, systems and facilities; (3) improving Americans with Disability Act (“ADA”) accessibility, parking and traffic circulation, and other infrastructure at facilities and fields (including paying the District’s Limited General Obligation Bond, 2023, issued for those purposes); and (4) making other safety, security, technology and infrastructure improvements.”

Great Northern School District - Proposition 1

Replacement levy for .103% property tax expected to generate about $840,000 to pay for general education and operation expenses.

The explanatory statement reads, in part, that the taxes collected “will be used to pay expenses of educational programs and operation not fully funded by the State, including teachers, nurse, extracurricular activities, technology, special education, transportation, non high payments, and building maintenance and operation.”

Liberty School District - Proposition 1

Replacement levy of .152% aimed at bringing in about $5.5 million for general fund spending on educational and operational costs.

The explanatory statement reads, in part, that the taxes for the replacement levy “will be used to pay expenses of educational programs and operation not funded or fully funded by the State, including, class size reduction, special education, nurses, counselors, safety staff, music, athletics, and extracurricular activities, curriculum, supplies, utilities, insurance, building operation costs, and professional development.”

Liberty School District - Proposition 2

Replacement capital levy asking for .014% and expected to bring in $525,000 over the next three years for the district Capital Projects Fund.

The explanatory statement reads, in part, that the money collected will be used “to pay costs of making District-wide technology, safety and security improvements, including: (1) continuing funding the acquisition and installation of technology equipment (including funding technology equipment to improve student learning), and making other related technology improvements and upgrades; (2) acquiring, installing, implementing and modernizing security cameras, entry/access controls, door locks and other safety and security systems; and (3) making other technology, safety, security and infrastructure improvements to school facilities.”

Mead School District - Proposition 1

Replacement levy for .25% expected to bring in more than $90,000 over the course of three years for general fund spending on educational and operational costs.

The explanatory statement reads, in part, that the passage of the levy would allow the district to “replace an existing educational programs and operations levy that will expire at the end of 2024. Taxes collected by this replacement levy will be used to pay expenses of programs, services, and staff not funded by the State, including, but not limited to, elective and advanced courses, special education, nurses, counselors, technology support, safety, security, performing arts, athletics, and extracurricular activities.”

Medical Lake School District - Proposition 1

Replacement levy for .155% expected to earn $6.2 million over the next three years for general fund educational and operational expenses.

The explanatory statement reads, in part, that the taxes will be used to pay for “expenses of educational programs and operation not fully funded by the State, including special education, teachers, nurses, counselors, mental health support, military and community family advocates, school psychologists, school resource officers, graduation readiness, technology, athletics, extracurricular activities, instructional materials, and building operations and maintenance.”

Medical Lake School District - Proposition 2

Replacement capital levy of .045% expected to bring in $1.9 million in revenue for modernization and remodeling of school facilities, including installing new air conditioning and a new roof.

The explanatory statement reads, in part, the taxes will pay “costs of making District-wide safety, security, technology and infrastructure improvements, including (1) upgrading and/or improving security cameras, entry controls and other safety and security systems; (2) acquiring, installing, implementing and modernizing computers, technology equipment, infrastructure, systems and facilities, and making other improvements and upgrades to the District’s technology systems and facilities, all to improve student learning; (3) upgrading, replacing and/or improving roofs and heating, ventilation and air conditioning equipment and systems (“HVAC”); and (4) making other safety, security, technology and infrastructure improvements to school facilities.”

Nine Mile Falls School District - Proposition 1

Replacement levy of .215% expected to bring in more than $13.5 million for general fund educational and operational expenses.

The explanatory statement reads, in part, that Prop 1 passing would allow the district to “replace an existing educational programs and operations levy that will expire at the end of 2024. Taxes collected by this replacement levy will be used to pay expenses of education programs and operations not funded by the State, including: safety, special education, music and fine arts staff and supports; nurses; counselors; class size reduction; athletics; and extracurricular activities.”

Reardan Edwall School District - Proposition 1

Replacement levy of .2% expected to bring in just more than $6 million for general fund expenses on education and operational costs.

The explanatory statement reads, in part, the taxes would pay for “expenses of educational programs and operation that are not fully funded by the State of Washington. These expenses include, but are not limited to: security, safety, athletics, extracurriculars, electives teachers, career and technical education, field trips, support staff, counselors, curriculum/technology, energy costs, custodial, maintenance, repairs and supplies.”

Riverside School District - Proposition 1

Replacement levy of .15% to bring in about $11 million for general fund expenses on educational and operational costs.

The explanatory statement reads, in part, that the taxes will be used to “pay expenses of educational programs and operation not funded by the State, including special education, nurses, counselors, school resource officers and safety staff, the arts, technology, athletics, extracurricular activities, instructional materials, and building operations and maintenance.”

Riverside School District - Proposition 2

A bond of no more than $73 million to renovate several schools, including Chattaroy Elementary School and Riverside Middle and High schools. The bond allows the district to levy taxes to pay the principal and interest.

The explanatory statement reads, in part, that Prop 2 passing would enable the district to issue bonds to “(1) renovate Chattaroy and Riverside Elementary, Riverside Independent Scholars Program (“ISP”) Building and Early Learning Center (security, classrooms, cafeterias, heating/cooling, parking/traffic safety); (2) renovate Riverside High (cafeteria, performing arts, vocational areas, classrooms, second gym, heating/cooling, parking/traffic safety); and (3) complete renovation of Riverside Middle (vocational areas, classrooms, heating/cooling, kitchen). The School Board determined that these projects were necessary to provide safe, updated facilities to improve student learning.”

Rosalia School District - Proposition 1

Replacement levy of .25% to bring in almost $1 million over two years for general fund expenses on educational and operational costs.

Rosalia School District - Proposition 2

Replacement capital levy of .045% expected to bring in $170,000 for modernization and remodeling of school facilities.

St. John School District - Proposition 1

Replacement levy of .16% expected to bring in almost $1 million over two years for general fund spending on educational and operational costs.

St. John School District - Proposition 2

Replacement capital levy of .129% to bring in about $700,000 over two years for construction, modernization and remodeling school facilities.

Tekoa School District - Proposition 1

Replacement levy of .25% expected to bring in more than $450,000 over two years for general fund spending on educational and operational expenses.

Tekoa School District - Proposition 2

Replacement capital levy of .25% expected to bring in more than $1.6 million over three years to fund modernization and remodeling of school facilities.

West Valley School District - Proposition 1

Replacement levy of .244% expected to bring in more than $30 million for general fund spending on educational and operational costs.

The explanatory statement reads, in part: “Passage of Proposition No. 1 would allow West Valley School District to replace an educational programs and operations levy that expires at the end of 2024. Taxes collected by this replacement levy will be used to pay expenses of educational programs and operations not funded by the State, including smaller class size, advanced courses, nurses, counselors, technology, safety, music, athletics, extracurricular activities, facility maintenance/repair and operations.”

West Valley School District - Proposition 2

A bond meant to bring in more than $92 million would be used to build a new middle school and expand kindergarten learning spaces in neighborhood schools, among other building projects. The bond allows the district to levy taxes to pay the principal and interest. This would be the first bond for the school district in two decades, according to the Spokesman.

The explanatory statement reads, in part, the district would use the taxes to “(1) construct a new middle school to replace Centennial Middle School; (2) add kindergarten learning spaces at neighborhood schools; (3) construct a new shared-campus building for West Valley City School and Spokane Valley High School; and (4) make District-wide critical capital improvements (including improving pickup/drop off areas at Seth Woodward and Orchard Center Elementary Schools). The School Board determined that these projects were necessary to provide safe, modern facilities to enhance learning.”